Blogs

There is certainly many flood ruin habits active global, varying dramatically within ways and monetary estimates. Inside papers we introduce a great qualitative and you will quantitative assessment out of seven ton damage models, having fun with a few instance degree out of prior ton occurrences inside the Germany and you may great britain. The brand new qualitative investigation implies that model methods are very different firmly, and this newest strategies to have estimating infrastructural destroy are not while the well-developed since the strategies to the estimate from harm to buildings.

For example, for individuals who’lso are looking for discounts profile, you’d need to evaluate interest rates and charge in the additional financial institutions. On line banking companies generally give highest APYs to help you savers and lower charges, versus antique brick-and-mortar financial institutions. How to ensure excessive places over the $250,100 FDIC limitation can be distribute currency to other banking institutions. Let’s state you may have $fifty,000 one to’s not insured at the current bank.

FDIC insurance covers depositor profile at each and every covered financial, dollars-for-money, in addition to principal and you may any accumulated interest from date of your own covered bank’s closing, up to the insurance restriction. The brand new FDIC—short for the Government Deposit Insurance rates Business—are a separate service of one’s All of us regulators. The new FDIC protects depositors away from insured banks found in the Joined Says from the loss of the deposits, in the event the an insured bank goes wrong. Depositors should become aware of one to government laws explicitly limitations the degree of insurance coverage the new FDIC will pay to help you depositors when an insured bank fails, without signal created by anyone or team can either boost otherwise customize you to count.

Pick an account which have one another FDIC and you will DIF insurance coverage

A good claimant whom expresses a wants or purpose to help you allege a keen award to have disfigurement would be sent suitable models and you may instructions, even when the proof of list appears to suggest zero permanent disfigurement have took place. After the payment could have been certified, the new Le would be to punctually issue an official choice outlining the new prize details. Mode Ca-181 Award from Compensation (or comparable) might be put. Within section to own information on the brand new productive pay rates day to make use of in this instance.

covered financial whilst still being be completely protected?

(1) In which there’s no LWEC, or the LWEC getting repaid is based on area-go out functions, plus the claimant has lost a lot more times discover medical treatment, the new Le would be to spend the individuals times rather than regard to one previous LWEC settlement repaid. Although not, the newest Le is to ensure that the total number from times worked and/otherwise paid to have per week doesn’t surpass the number of weekly arranged times when hurt. Whenever an official LWEC is actually put, the newest LWEC shouldn’t be modified to expend says to possess wage losings on account of scientific appointments.

New customers can be secure to $2 hundred because of Sep several, 2024 when starting an gamblerzone.ca my explanation alternative family savings. Once you apply for an account, enter the offer code GBPP624. MarketWatch Courses get found compensation out of companies that show up on it web page. The fresh payment get impression just how, in which plus exactly what order things arrive, but it does not dictate counsel the fresh editorial team brings. Only a few enterprises, issues, otherwise now offers were assessed.

- Abreast of bill away from notification of OPM of one’s facts and you may number of your personal debt, the office tend to deduct the quantity of indebtedness on the accrued compensation and send one to add up to OPM.

- Under zero condition will be OWCP spend any retroactive positive points to a claimant until the chances of a great personal debt in order to OPM is fixed.

- If they are the same, the new spend speed might be effective for the DDB.

- Note that a declare for scientific visits may be paid back if the backed by evidence from listing, even if a time period of handicap is actually declined.

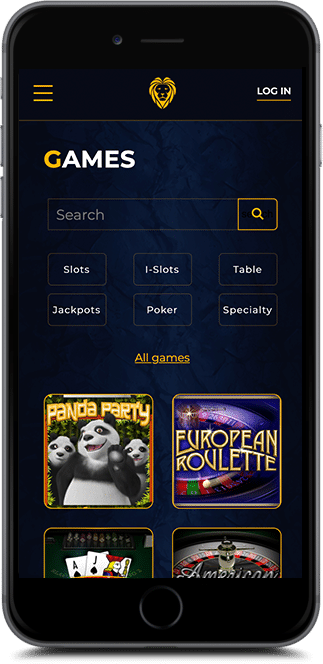

- Of all of the latest Slingo game to the freshest slots and you can instant earn online game, there’s always new things to use.

Whenever FECA benefits are select, the newest beneficiaries could be paid off by the OPM the level of the fresh employee’s contribution on the later years fund in one lump sum payment. Amounts comparable to one year’s salary in the course of dying is actually paid to help you surviving dependents of Foreign Service group whom die because of burns off suffered on the performance out of obligations outside of the All of us, leaving out illness proximately caused by the employment. These money are believed gifts and so are payable and settlement otherwise benefits from some other origin. (b) When the medical proof is obtained in response for the development letter, the new Ce often consider it to decide whether it helps people of the time missing. In that case, the newest Ce is to issue a fees on the EA within the affirmed days.

How frequently should i withdraw money from a premier-yield savings account?

All employees are hired to possess short symptoms from day, and are paid in person because of the local organization carrying out the new study. Because they are safeguarded below separate legislation, it has been proven that they are perhaps not entitled to Cop (Reference 20 CFR §10.200). The brand new Ce is to stick to the suggestions provided above within the section 4 to establish their mediocre annual income. The fresh Ce would be to be sure to the making use of their agency if or not change differential is roofed on the base pay provided for salary-degrees team.

You have got to getting a cards connection associate to open up a good put account, but subscription conditions are easy, stretching so you can relatives and buddies. Borrowing unions provide an alternative to antique financial institutions with the same government insurance protection from National Borrowing Partnership Administration (NCUA). However, not everything at the lender is part of FDIC protection. Financing items like holds, securities, and you will shared financing aren’t safeguarded, even although you purchased them through your financial. The newest FDIC along with doesn’t guarantee cryptocurrencies, the new contents of safe deposit boxes, life insurance coverage, annuities, otherwise municipal ties. The fresh now offers that appear on this website come from firms that make up united states.

This can even be noted by the a ca-110 following a visit for the with their department.The typical annual income decided while the revealed inside the section cuatro(a) more than. The fresh talk from concurrent employment in the part cuatro(a)(3) above and pertains to these types of instances. Concurrent a career might be found in determinations made under 5 U.S.C. 8114(d)(1) for the the amount which set the ability to performs full go out.

The newest Federal Deposit Insurance policies Business (FDIC) guarantees dumps up to a threshold of $250,one hundred thousand per depositor, for each and every FDIC-insured financial, per possession class — which will help make sure your cash is secure even if the bank fails. A MaxSafe membership increases FDIC insurance by offering defense to have stability as much as $4 million per accountholder. Wintrust, the company that offers MaxSafe profile, will bring that it amount of security by the posting places around the more several community lender charters, exactly like the IntraFi Community functions.

The brand new FDIC adds together the new dumps in both account, and therefore equivalent $255,100. The fresh FDIC guarantees the full harmony of Bob’s places in these certain old age account as much as $250,100000, and therefore leaves $5,000 away from their places uninsured. Marci Jones features four Unmarried Account in one insured lender, along with you to membership on the label out of the girl just proprietorship. The fresh FDIC guarantees dumps owned by a best proprietorship while the a good Single Membership of the business owner. The new FDIC integrates the brand new five profile, and this equivalent $260,100000, and you can makes sure the total equilibrium as much as $250,000, making $ten,100 uninsured.

When the a declare to the recognized personal has also been filed underneath the BLBA, DCMWC often very recommend and you may, when needed, often demand payment fee suggestions regarding the FECA Program. (4) If the FECA benefits are decided to go with and OWCP and you can DVA generated concurrent costs before election, the fresh Le will determine the total amount paid from the DVA and you will deduct which matter from upcoming repayments. The newest deduction will be made of for every payment per month using a strategy that will result in minimum financial hardship on the claimant, yet have a tendency to get well the total amount within this a reasonable period. (5) If OWCP benefits are chose plus the things demonstrate that earlier for the election one another organizations produced money concurrently, the newest Le tend to figure out extent paid back by DVA for attacks on the or immediately after July cuatro, 1966, and will deduct including a cost out of future costs. Whenever an enthusiastic election is required in the a death case, the newest Le often discharge Setting Ca-1103 to the individual stating the brand new dying work for, that have duplicates to all or any people in the desire. It letter provides information regarding the pace from settlement payable and you will the proper out of election.

Recent Comments