You worked for ages to really make it owing to scientific college and you may be a doctor. Since the home or fellowship is originating so you’re able to an-end, you might be willing to get a fantastic house in your city very that you can settle down. Unfortunately, medical college is expensive plus family savings has less cash involved than just you expected it would once you felt like that it was time to settle down.

Medical practioners, nurse practitioners, and you will veterinarians the same get qualify for financing which is simply available for individuals with a good doctorate (and a career regarding the medical occupation). There are lots of professionals that produce your medical professional mortgage a better option for your than just a classic mortgage.

Read on to know the method that you you will take advantage of a doctor mortgage mortgage on your first decades as a physician.

Lower Interest levels

Since personal loans in New Hampshire for bad credit certain doctor financial cost are influenced by a doctor’s financial situation, you may be thinking how you can score a decent price on your own financing rather than many money in to your offers account. You might not have even a job from the scientific occupation yet. If you’ve been working as a keen intern, a resident, or a fellow and you’ve got a contract having a position with one to health, you’re eligible for a health care provider financing.

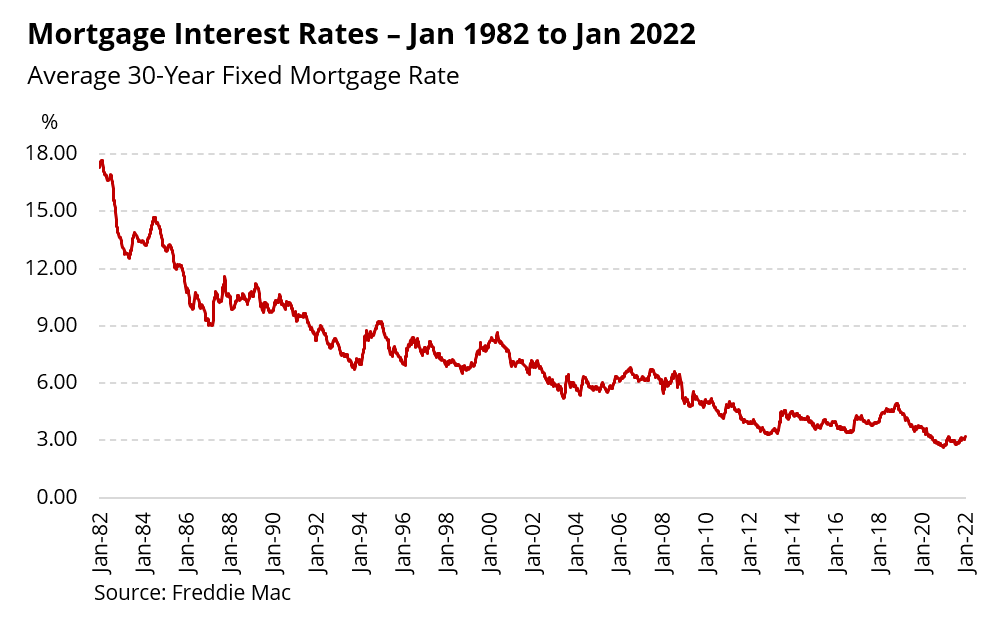

If you’re medical practitioner mortgage rates could well be lower today, it is important to keep in mind that interest levels can increase along the lifetime of the loan. Fortunately, there are choices to re-finance and get greatest rates when you’ve made payments promptly.

Casual Financial Criteria

You need to have over an excellent doctorate so you’re able to be eligible for a doctor mortgage. You’ll want proof the a job and you can earnings into the the career. Antique finance want paystubs ahead of it imagine providing you with a property financing that displays your a position record regarding the recent years.

Very, how do you show this when you haven’t but really landed your own basic business while the a doctor? Towards doc financing, you can buy home financing toward vow away from an work price when your internship, residency, otherwise fellowship ends. This makes the complete procedure less costly to possess physicians merely bringing were only available in the professions.

Lower if any Downpayment

Medical professionals below 10 years from medical college are most likely getting strapped for money. Anyway, spending less is hard when you find yourself keeping on top of your own student loan money, investing lease, and you may using the chatrooms toward an intern, citizen, fellow, or gonna doctor’s salary.

Luckily for us, physician loans offer doctors the possibility to close towards a property without paying a cent upfront. This will be just the thing for homebuyers making an application for to your an effective new house as fast as possible. It permits these to get it done without the need to save yourself various away from thousands of dollars because of their down payment first.

Highest Debt-to-Earnings Proportion

Your debt-to-money ratio of a health care professional can make it impractical to rating financing who has got all the way down interest rates. As a result old-fashioned lenders can get refuse the job, even though you have a very good credit history and you will/otherwise bring a down-payment.

The lenders of physician mortgage loans are more inclined to succeed a high DTI ratio while they remember that the brand new physicians features a huge amount of college student obligations. Old-fashioned loan providers, however, you should never worry should your financial obligation is related to copious college loans as they nonetheless comprehend the increased DTI since the a risk one to they don’t must get.

How come medical practitioner mortgage brokers overlook the healthcare provider’s current financial situation? Physicians are safe prospects! Lenders be aware that medical professionals possess increased making prospective more the life span of the financing.

Reference to The Bank

Loan providers are often in search of people who have increased income making possibility to sell to. Giving fund that have everyday monetary conditions, straight down interest rates, and low-down payments are merely a few of the things that they’ll do to write such relationships with the subscribers.

A physician loan is a wonderful starting place building a great relationship to possess coming finance that you might want to consider bringing call at the long run.

Medical practitioner Loan Mortgage

Doc Domestic Funds could have been providing d house which have a physician mortgage mortgage for more than ten years. We understand you to the newest medical professionals possess a number of college student obligations or other conditions that you’ll prevent them out-of taking financing acceptance. I plus understand that you might want to enter into their new house before you start the fresh work.

The doctor home mortgage makes that it you’ll. I enjoy working for you intimate in your fantasy family as fast as possible towards most readily useful doctor loans!

Recent Comments