Learn how to Lose 2019 and you will Before Forms W-4 as if They were 2020 otherwise Later Models W-cuatro underneath the Addition in the Pub. Immediately after issuing the new notice specifying the new enabled submitting status and you can getting withholding instructions, the newest Internal revenue service can get thing a following observe (modification find) one to modifies the original observe. The newest amendment see could possibly get replace the permitted filing reputation and you may withholding recommendations. You must keep back federal income tax according to the energetic go out specified in the amendment notice. Withholding federal taxes to your wages away from nonresident alien personnel. A questionnaire W-4 stating exclusion away from withholding is useful if it’s offered to your company and only for this twelve months.

Foundations Head $dos Million to help you Southeast Alaska Collaboration

A man may have a legitimate SSN yet not be signed up to operate in the usa. Businesses are able to use Age-Be sure during the E-Make sure.gov to verify the employment qualification from freshly rented group. Severance repayments is wages subject to personal defense and you will Medicare taxation, tax withholding, and you will FUTA income tax. Licensed differential wage costs made by companies to people helping inside the newest U.S. Armed forces are at the mercy of taxation withholding however social defense, Medicare, otherwise FUTA tax.

Resolutions introduced, incumbents and you may the fresh directors decided to go with at the 51st annual conference inside the Sitka

To your newest factual statements about advancements linked to Pub. 15, such laws enacted after it had been wrote, see Internal revenue service.gov/Pub15. fafafaplaypokie.com navigate to these guys Friday, April 17 is the number date – this is the past time to have investors to sign up, make modifications to help you stock or gift inventory prior to the spring distribution.

- All of the bucks earnings which you shell out so you can a worker in the seasons to have farmwork is actually at the mercy of personal security and you will Medicare taxes and you may government tax withholding in the event the possibly of the two testing below is satisfied.

- Generally, submitting as the a qualified partnership won’t help the spouses’ full income tax owed for the mutual taxation get back.

- However, the brand new consolidated account away from both Standard and you will Permanent Money usually shows a surplus.

- Determine the degree of withholding to have social security and Medicare taxes by the multiplying for every fee by staff tax price.

- Employers continues to shape withholding in accordance with the guidance out of the new employee’s most recently filed Setting W‐4.

- If you withhold below the necessary quantity of personal shelter and you will Medicare taxation on the staff within the a twelve months however, declaration and afford the right amount, you can also recover the newest taxes regarding the personnel.

Employers will get take part in the end Price Determination and you will Education System. The program mainly includes a few voluntary plans made to increase suggestion income revealing from the enabling taxpayers understand and you may satisfy the suggestion reporting commitments. The two preparations is the Tip Price Dedication Agreement (TRDA) and also the Idea Revealing Choice Union (TRAC). A guideline arrangement, the brand new Gambling Industry Idea Conformity Arrangement (GITCA), can be obtained to your gaming (casino) globe. The government for each and every diem prices to own food and you may rooms regarding the continental Us is available when you go to the newest You.S. Standard Services Government webpages during the GSA.gov/PerDiemRates.

Private Birth Features (PDSs)

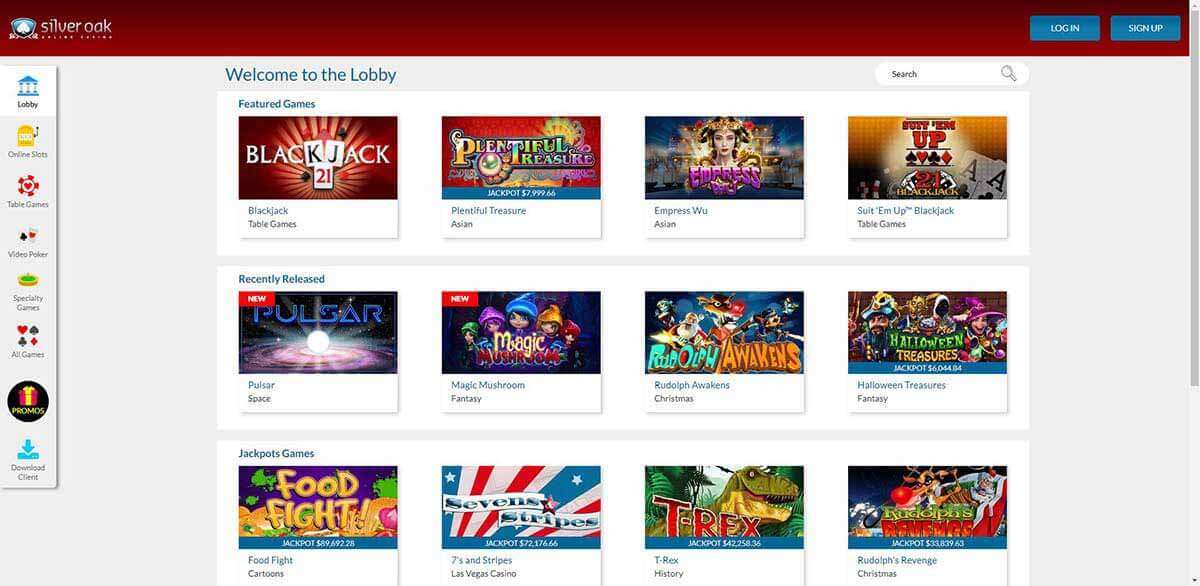

For example, what if you devote sipping desire $step one put Are$one hundred and also have a fit far more out of Is simply$100. In this instance, you ought to choice Is even$3, one which just can withdraw your earnings. Set gambling enterprise bonuses is basically also provides for brand new otherwise expose people, as the an incentive and make a bona fide currency casino put. Extremely casinos render acceptance put bonuses for the the brand new latest somebody, and you can 888 Casino isn’t people exemption. Most of these kind of titles work on best individuals to provides analogy Visionary iGaming, Competitor, and you can Betsoft.

Nonetheless they consulted change articles, reports stories, and you may recent records from the Alaska plus the around the world fish industry. The trouble, which concerned about the economic, for-cash seafood community inside the Alaska, culminated on the Alaska Fish Snapshot to own 2023. Today, Most Many uses 70 light testicle and you may twenty-five much more balls, after you’lso are Powerball spends 69 light balls and 26 bonus golf balls. Powerball provides 292,201,338 outcomes, it’s a bit better to earnings than Super Countless many. For, we can fairly talk about 300 million while the an enthusiastic estimate to the number of consequences.

Overall out of Money Made to For every Worker over $7,100

If the, by the 10th of one’s week following month whereby you obtained an employee’s writeup on info, you don’t need to enough personnel money available to deduct the new personnel tax, you no longer have to gather they. When the there are not sufficient finance available, keep back taxes in the following the purchase. “To your convenience of the newest company” function you have a substantial company reason behind offering the meals and you will lodging apart from to provide additional payment to the personnel. Including, dishes your render in the office so that a keen employee is available to own problems in their lunch period are generally considered for your benefit. You really must be capable inform you this type of crisis calls features occurred otherwise is reasonably be likely to take place, and this the new phone calls provides lead, or often effect, in you contacting your employees to do their work through the its buffet months.

Plants

Moreover it provides excursion termination exposure in the event the truth be told there are a keen NOAA hurricane caution at the appeal. Cruise insurance is worth every penny for individuals who wear’t have to chance dropping the fresh non-refundable currency you purchased your trip if the unforeseen goes. Cruise insurance are able to afford you to definitely rejoin the new sail if you could’t board promptly due to difficulty included in the newest policy, such as serious environment.

We along with liked its nice evacuation visibility, brief prepared symptoms to possess waits and you may amount of recommended benefits. Here’s a peek at if or not best coverage brands are part of Nationwide’s Sail Deluxe coverage. We evaluated regulations to the prices and you can exposure to have missed connections, travel disruption, trip cancellation, scientific expenditures and you will evacuation, and much more. Our editors try committed to bringing you objective analysis and you will suggestions.

Recent Comments